Faster business growth on average for funded businesses

Faster business growth on average for funded businesses

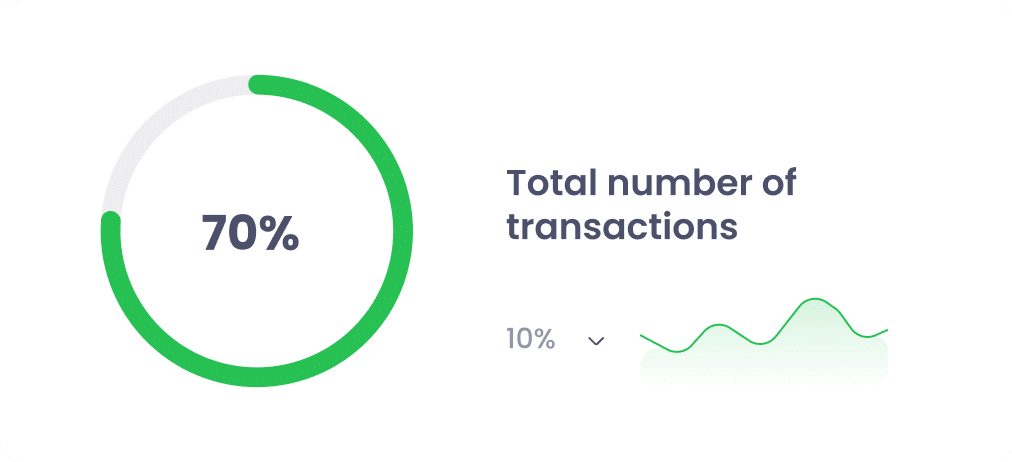

Application approval rate for qualified businesses

Payment Pros offers a suite of essential tools and features designed to simplify and optimize your payment processing.

Our streamlined application process is designed to be simple and efficient, allowing you to access the funds you need without unnecessary delays.

From merchant cash advances to equipment financing, we offer a variety of funding solutions to suit your specific business requirements.

We believe in transparency and fairness. Our funding options come with competitive rates and clear terms, ensuring you know exactly what to expect.

Our experienced funding specialists take the time to understand your business goals and provide personalized recommendations to help you succeed.

Upgrade and expand your operations with our equipment financing options, providing the capital necessary to acquire the tools and technology your business needs.

Flexible Terms

Choose repayment schedules that align with your cash flow and operational needs.

Preserve Cash Flow

Maintain your working capital by spreading out equipment costs over manageable installments.

Fast Approval and Funding

Get the equipment you need promptly with our expedited financing process.

Wide Range of Equipment

Finance a diverse array of equipment, from machinery and technology to vehicles and office essentials.

Immediate Access to Funds

Secure the necessary capital quickly to cover operational expenses, inventory, or other immediate needs.

No Collateral Required

Obtain unsecured financing based on your business’s performance without risking personal or business assets.

Flexible Repayment Options

Tailor your repayment schedule to match your business’s revenue cycles and cash flow patterns.

Easy Application Process

Simplified paperwork and fast approvals to get you the working capital you need without hassle.

Scalable Funding Options

Receive the capital you need at various stages of your expansion, ensuring flexibility as your business grows.

Competitive Rates

Benefit from attractive interest rates that make financing your expansion affordable and sustainable.

Strategic Growth Planning

Access expert guidance to help plan and execute your expansion strategies effectively.

Quick Approval Process

Streamlined applications and fast approvals to keep your expansion plans on track without delays.

Our merchant cash advance program provides flexibility and ease of repayment, aligning with your business’s cash flow.

Quick Access to Working Capital

Get the funds you need within days, not weeks, to seize opportunities or handle unexpected expenses.

Streamlined Approval Process

Simple documentation requirements and decisions within 24-48 hours, letting you focus on running your business.

Flexible Repayment Structure

Payments adjust automatically with your daily sales, ensuring manageable cash flow during both peak and slow periods.

No Collateral Required

Unsecured funding based on your business performance, not your assets or personal credit score.

By partnering with Payment Pros for your funding needs, you can take your business to new heights. Our solutions are designed to provide the capital you need to invest in your growth, optimize your operations, and achieve your goals.

Most businesses qualify if they have:

Our streamlined process means you can receive funds in as little as 24-48 hours after approval. Merchant cash advances typically process the fastest, while equipment financing may take slightly longer.

Funding amounts range from $5,000 to $500,000+, depending on:

Basic requirements typically include:

Repayment methods vary by funding type: